A Collaborative Approach to Agricultural Management

OAHU AG & ENERGY HEDGE PROGRAM in the agriculture and softs integrates front end technology for our clients that offers the benefit of intuitive management while our team handles mid and back office tasks.

Many producers or processors prefer to focus on their core physical operations as opposed to having to learn perplexing details behind various futures and options strategies. They have ready forecast estimates of costs in upcoming months with an understanding of seasonal factors that can impact their business with price risks.

What they need is a means of communicating concerns behind their physical operation with a team who can assist with managing sophisticated derivative strategies to meet their objectives. And, that's what we do.

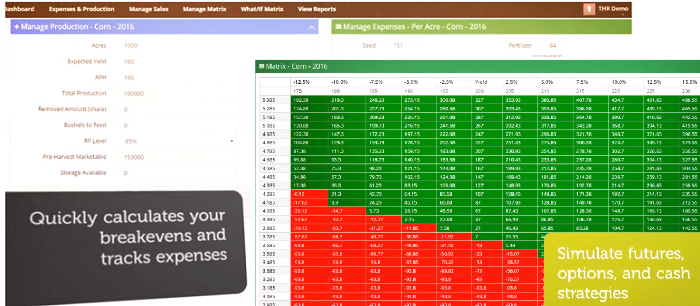

Below is an example on how Oahu's team helps integrate the use of technology in ways that make sense for our clients. While an oilseed producer may have an intuitive feel for price changes that could impact sales prices near harvest, a useful tool will help decisions as:

- What's the ideal combination of forward contracting should I do with futures or options?

- If I feel yields will fall, how much insurance should I purchase with above?

- At different scenarios for both price & yield, what combination above is the best scenario?

Clients use an intuitive tool designed to help create scenarios based on their knowledge managing their physical commodities business. Meanwhile, our team assists with derivative strategies that accomplish their goals.

Ask about solutions we can offer for Livestock, Grain, Oilseed, Fuels, Softs (Coffee, Cotton, Palm Oil, Rubber, and more). We also offer hedging currency risk for importers / exporters on FX. Oahu's strategy advisory is also available with hedge accounting and CTRM services.

How do you create a "price ceiling" using futures or call options to control rising input costs? Oahu manages instruments to achieve price caps or floors to control the risk of rising cost or falling prices.

Examples of questions:

- If basis strengthens on our cash livestock, how will that affect our selling price and what are some strategies?

- What are alternatives to purchasing put options on Lean Hogs if premiums are too high?

- We want to sell partial inventory of grain in storage but feel prices will continue to rise.

- If corn prices are expected to trade in a narrow range in upcoming months should I hedge with an ATM call or purchase a call spread and finance it by selling puts?