Structured Commodity Finance (Summary)

We work with clients to arrange the funding and monetization of fungible inventories and cargoes of both exchange-traded and non-exchange deliverable, physical commodities.

Our services include:

- Structured and transactional trade finance

- Physical repo as a form of inventory financing

- Risk mitigation management

Funding sources for these commercial transactions include private equity, hedge funds, and traditional international trade finance institutions.

Oahu Capital deals specifically with exchange listed fungible commodities in the energy and agricultural sectors.

We work with a wide range of clients from local dairy, grain and beef producers, importers, exporters to manufacturers, refineries, airlines, fleet operators, ingredient and feed processors.

Physical Commodity Repo

It's frustrating when your business needs cash for operations which is tied in raw material or physical inventory that won't be used for another 60 - 90 days.

Many businesses are faced with challenges in operational cash flow due to assets held in storage as inventory.

Examples range from raw inputs for an AFO (animal feed operation) to bunker fuel for a shipyard, diesel fuel for a fleet of delivery vehicles or chemical feedstock on petrochem production.

Having to order physical supplies in advance to account for shipping lead times or timing purchases for favorable input costs in volatile price environments is sometimes necessary. Unfortunately, these decisions could tie up cash for other aspects of operating.

Click to read Oahu's solution

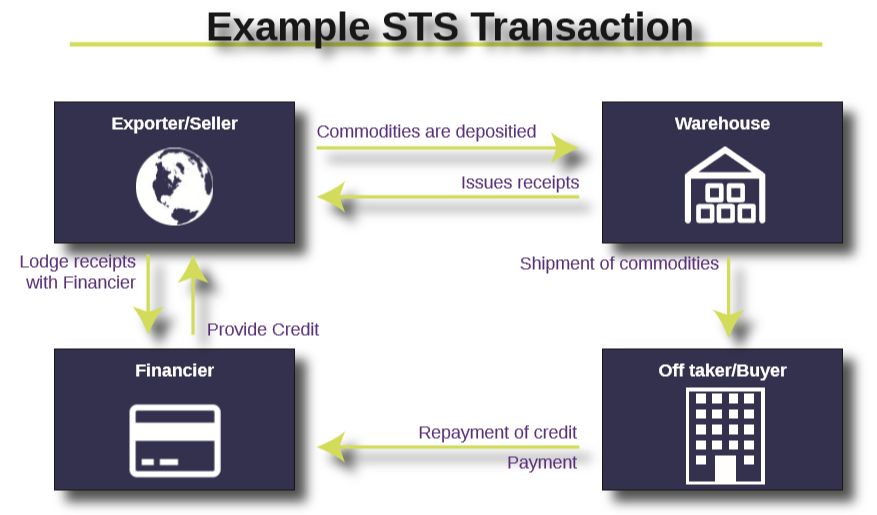

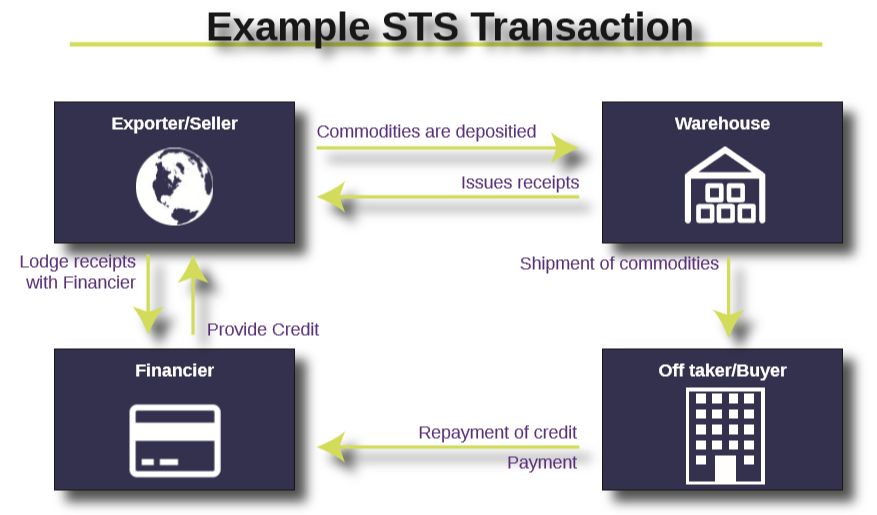

A physical repo is a form of inventory financing and is based on the sale of a commodity with the agreement to repurchase at a later stage.

One of the biggest challenges for SMEs is that many funders in the traditional banking sector either charge exhorbitant rates that eat into profit margins. Or, they have moved away from commodity financing altogether. This is especially true in the bulk commodity trade finance space.

A number of institutions also believe the costs associated with underwriting short term commodity financing outweigh the benefits of serving this sector.

Regulations and oversight require documentation for audit purposes that fail to meet the timing needs of the business with many applications being rejected.

The expense of KYC (Know Your Customer) with time and risk involved to assist SME's in their view far outstrip any gain. Oahu Capital and its partners seek to bridge this gap in assisting businesses with operational financing in the form of physical repos.

Oahu Capital's financial partners purchase commodity against cash, while having the customer sign a repurchase agreement specifying the commodity repurchase date.

The customer is able to obtain short term funding to meet their operational cash flow needs and later repurchase physical inventory at an agreed upon price plus fees. The repo rate as part of the fee structure is based on the difference between the purchase and repurchase prices, determined by an agreed upon interest rate.

The typical transaction cycle could be anywhere from 30 - 90 days.

Here's a tip: If you're a producer (short hedger), a physical repo could be beneficial if prices are currently at what you want. Rather than bearing margin requirements on being short futures to hedge a potential fall on physical selling price at a later date, the position falls on the underwriter of the physical repo. Your price is locked under a repurchase agreement in the future.

Complete our form and let's discuss how our solutions might help your business.