A Statistical Approach to Energy Management

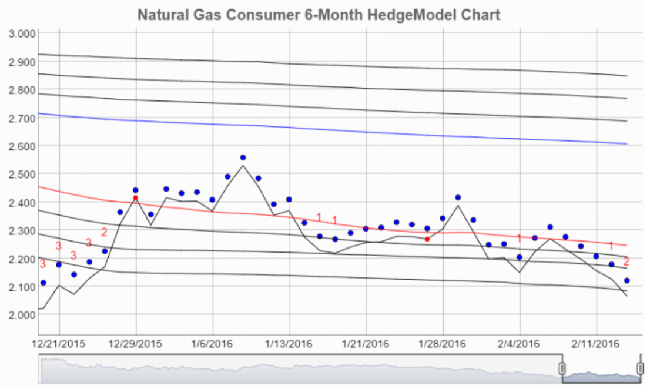

Oahu's Commodity Margin Management program in the energy sector focuses on providing our clients decision tools and strategies around methodical statistical models.

Along with offering energy forecasts and analysis, our team offers an experienced advisory to craft corporate hedging policies that meet defined price risk objectives.

Oahu's team collaborates with our clients to establish logical steps, objectives and optimal trade offs which need to be defined at the start. Talk with our team and we'll cover a series of steps to see if a hedging program makes sense for your operation. What are best and worst case scenarios? What can you hope to achieve?

Whether you're an oil & gas producer, refinery, consumer of bunker or jet fuel, through our discussions, we'll assess the impact of commodity markets on your business.

Our process is based on a comprehensive statistical approach to eliminate guesswork. When establishing your firm's objectives, our models identify when to hedge, which contract maturity, how to scale in and when to restructure. Schedule a call with our team and we'll layout a progression of steps on how to get started.

We'll look at:

- Basis, Correlation, Regression Analysis

- Seasonality Issues

- Storage Economics

- Risk Analysis & VaR Estimates

Having organized trading desks with specific policies documented to manage hedging activity, our team has designed both producer and consumer models for energy management.

How do you create a "price ceiling" using futures or call options to control rising input costs? Oahu manages instruments to achieve price caps or floors to control the risk of rising cost or falling prices.

Examples of Hedging Scenarios:

- At the end of January, you decide to hedge your April crude oil production by selling an April Brent Crude Oil swap at a price of $65/barrel.

- In February, you decide to hedge your anticipated April Singapore fuel oil consumption and purchase an April Fuel Oil 180 CST Singapore APO (Average Price Option) call option.

- In November, you decide to hedge your January propane consumption. You purchase a January Mont Belvieu propane call option. To reduce the cost of the call option, you also decide to sell a slightly OTM put option.

Schedule time on our calendar to discuss price risks in your business and let us demonstrate how we can help.

Click here on why consider a statistical approach